2024 IL Market Research: Logistics IT Steps Up

IL’s annual report illuminates how companies are increasing supply chain technology investments to become more efficient and light up return-on-investment.

The collapse of the Francis Scott Key Bridge in Baltimore illustrates all too clearly how perilous the world can become for supply chains. A disaster can close a port, forcing shippers to reroute loads at a moment’s notice.

Attacks on shipping in the Red Sea and a drought that has curtailed traffic through the Panama Canal are also making shippers rethink their logistics strategies.

Wars, geopolitical tensions, inflation, and other trends complicate supply chain strategies as well.

Add to that the day-to-day challenges of supply chain management—routing shipments, scheduling labor, meeting customers’ ever-more-stringent requirements—and it’s no wonder demand is growing for information technology (IT) solutions that address logistics and supply chain management.

According to Inbound Logistics’ latest survey of the logistics IT market, 86% of logistics IT vendors have gained more customers over the past 12 months.

As we do each year, Inbound Logistics surveyed a broad assortment of logistics technology providers, asking for their views on the current market.

We then compiled and analyzed their responses, providing insights that we hope will help logistics professionals find new technologies to support their own operations.

Once you’ve read the 2024 survey results, check out this year’s Inbound Logistics Top 100 Logistics & Supply Chain Technology Providers, a valuable reference as you explore how best to invest in technology to serve your company’s specific needs.

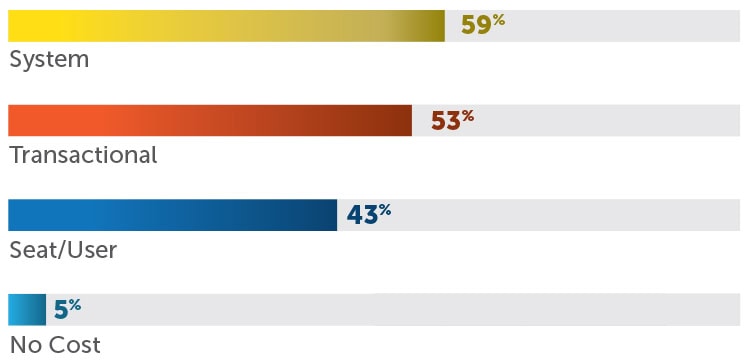

Pricing Model: How do your customers pay for your solutions?

Although many technology vendors offer software-as-a-service by subscription, the practice of buying a solution outright still plays a significant role. Fifty-nine percent of the IT vendors we surveyed this year offer system-based pricing, up from 41% in 2023. And a markedly smaller proportion of vendors this year have customers who subscribe to technology based on transaction volume—53% vs. 77% in 2023.

Companies that want to pay by the seat or user will find that option with 43% of vendors this year. And 5% of vendors offer technology at no cost. That arrangement typically occurs when a partner such as a 3PL provides an IT solution as part of a broader array of services.

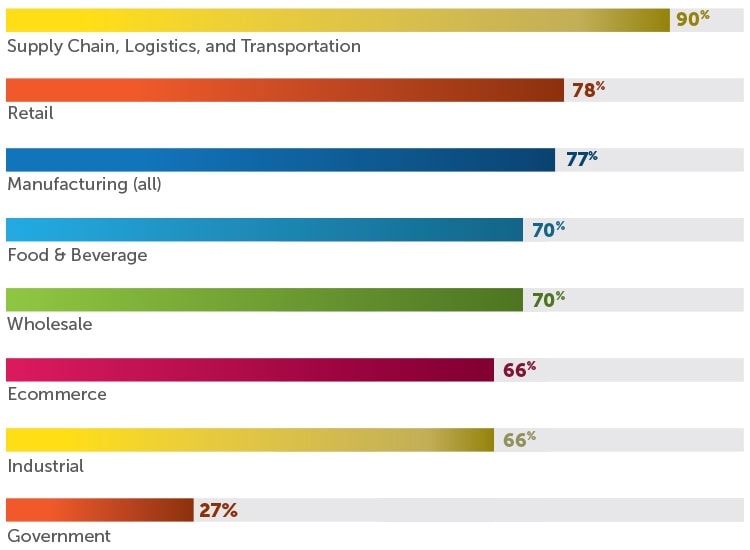

Industry: What industries do your solutions serve?

The vast majority of vendors in the survey—90%—report they serve customers in the supply chain, logistics, and transportation sectors. This is no surprise, since many of the technologies they sell fill the needs of 3PLs, carriers, and other service providers as well as the needs of shippers.

Those shippers are most likely to come from the retail (78%) or manufacturing (77%) industry. Both of those sectors appear to be stronger markets for logistics IT than they were in 2023, when 61% of vendors said they served retailers and the same proportion provided technology to manufacturers. Two other strong sectors are the food and beverage industry and wholesale businesses, each mentioned by 70% of vendors who completed the survey.

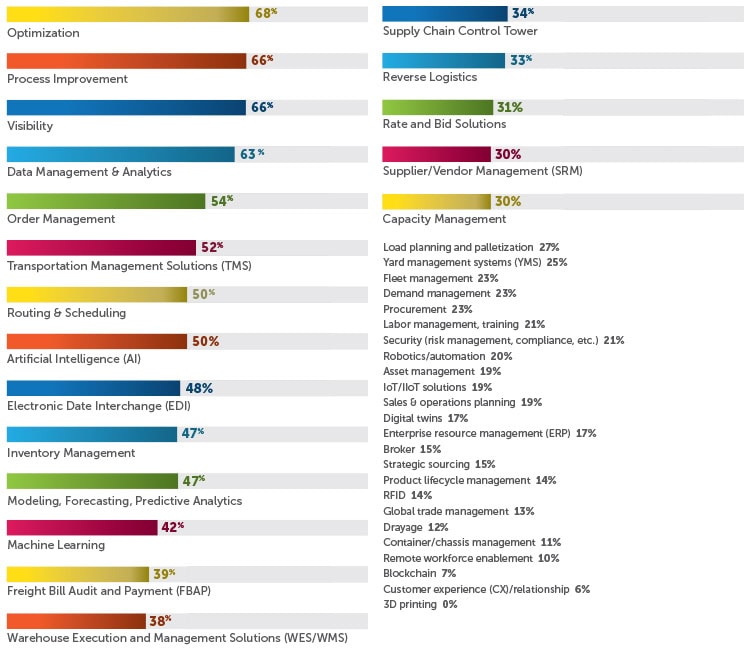

Solutions: What logistics and supply chain solutions do you offer?

Shippers cut costs and gain competitive advantage when their operations run more effectively. Many vendors offer technology to help shippers make those improvements.

For instance, 68% of the vendors in our survey provide optimization solutions to support, and often automate, better decision making across a range of functions.

Nearly as many—66%—offer solutions for process improvement. The same proportion of vendors include visibility solutions in their portfolios. These might keep users aware of anything from the status of shipments in progress to the productivity of individual workers, or the evolving risk of supply chain disruptions.

Another popular category is data management and analytics, which helps users extract business intelligence from operational data.

Among solutions for specific logistics functions, the most popular include order management systems (54%), transportation management systems (52%), and solutions for routing and scheduling (50%). Technologies for specialized functions that are harder to find include solutions for managing containers or chassis (offered by only 11% of respondents), drayage (12%), and global trade (13%).

Half the IT vendors in the survey provide solutions that incorporate artificial intelligence (AI), up slightly from 44% in 2023. This year, 42% offer solutions that incorporate a related technology: machine learning. But two other advanced technologies that have won attention in recent years have made little impression on logistics. Only 7% of vendors offer solutions based on blockchain, and no one this year reports any solutions that involve 3D printing (down from 3% in 2023).

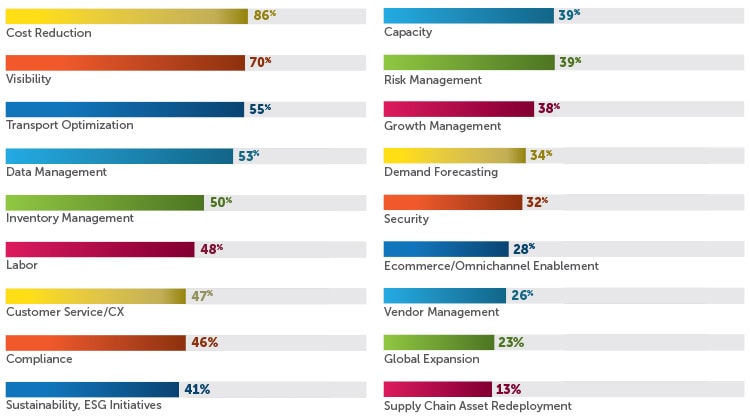

Challenges: Which supply chain, transportation, and logistics challenges are the most critical for your customers?

In an era of inflation, cost reduction tops the list of critical challenges for IT vendors’ customers. In 2024, 86% of vendors cite cost reduction as a critical issue. That’s up from 78% in 2023, although not quite as high as the 94% who mentioned this challenge in 2022, when supply chains still struggled with the worst effects of the pandemic.

Another common challenge today for shippers who implement logistics IT solutions is how to maintain visibility into their operations; 70% of vendors cite that issue.

After that, the list of most critical issues depends on whom you ask. About half of vendors mention transport optimization, data management, inventory management, and labor.

Although the U.S. labor market is slightly looser than it was at this time last year, we still find more IT vendors name labor as a critical challenge for their customers this year (48%) than in 2023 (37%). On the other hand, concern about capacity has plunged: 39% of vendors list that as a critical challenge in 2024, vs. 61% in 2023.

It’s interesting to note that only 28% of vendors mention ecommerce or omnichannel enablement as a critical challenge, compared with 41% in 2023. We doubt that shippers are less interested today in multichannel sales and fulfillment strategies. Perhaps most companies that need those functions have already put good solutions in place, eliminating this issue as a significant pain point.

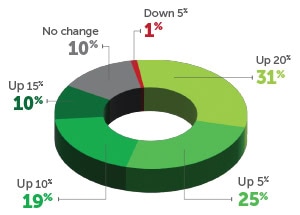

Customers: During the last year-on-year period, did you customer base grow or shrink? About how much?

While the vast majority of IT vendors say their customers are trying to cut costs, customers’ budgets still find room for IT investment. This makes sense, as digital solutions can yield insights and efficiencies that help companies spend less and earn more in the long run.

While the vast majority of IT vendors say their customers are trying to cut costs, customers’ budgets still find room for IT investment. This makes sense, as digital solutions can yield insights and efficiencies that help companies spend less and earn more in the long run.

In 2024, 86% of respondents report that their customer base has grown since last year. Forty-one percent have seen growth of 15% or more. Ten percent of IT vendors have about the same number of customers as they did one year ago, and only 1% have lost customers.

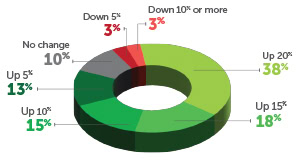

Sales: During the last year-on-year period, were sales generally up or down? About how much?

Not only did more customers embrace logistics IT, but they spent more money on those solutions overall. Despite a tight economy, 84% of vendors in the survey saw sales increase since last year. For more than half, revenues went up by 15% or more, while 15% reported 10% growth and 13% reported 5% growth. A small proportion—6%—saw a year-on-year decrease in sales.

Not only did more customers embrace logistics IT, but they spent more money on those solutions overall. Despite a tight economy, 84% of vendors in the survey saw sales increase since last year. For more than half, revenues went up by 15% or more, while 15% reported 10% growth and 13% reported 5% growth. A small proportion—6%—saw a year-on-year decrease in sales.

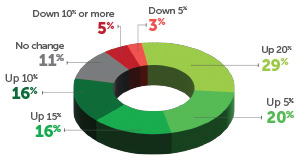

Profits: During the last year-on-year period, were profits up or down? About how much?

Even in an uncertain economy, profits remain strong for many logistics IT companies. Among vendors who responded to the survey, 81% have seen profits rise over the last year-on-year measurement period. That’s only a slightly smaller group than the 87% who reported such an increase one year ago. The past year hasn’t been smooth sailing for everyone, though. Eight percent of respondents in 2024 saw net income decrease over the past year-on-year period. In 2023, only 1% of vendors saw profits shrink.

Even in an uncertain economy, profits remain strong for many logistics IT companies. Among vendors who responded to the survey, 81% have seen profits rise over the last year-on-year measurement period. That’s only a slightly smaller group than the 87% who reported such an increase one year ago. The past year hasn’t been smooth sailing for everyone, though. Eight percent of respondents in 2024 saw net income decrease over the past year-on-year period. In 2023, only 1% of vendors saw profits shrink.

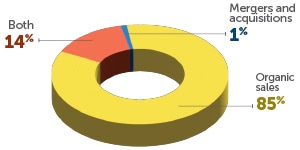

Growth: What lead to growth in the past year?

Most of the growth that logistics IT vendors enjoyed over the past year came from organic sales. Eighty-five percent of survey respondents told us their companies are growing stronger thanks to revenue from customers. Another 14% attribute their growth to a combination of sales and merger and acquisition activity, while just 1% have M&A entirely to thank.

Most of the growth that logistics IT vendors enjoyed over the past year came from organic sales. Eighty-five percent of survey respondents told us their companies are growing stronger thanks to revenue from customers. Another 14% attribute their growth to a combination of sales and merger and acquisition activity, while just 1% have M&A entirely to thank.

WHAT DRIVES DEMAND FOR LOGISTICS IT?

We asked vendors where—function, vertical market, or geography—they see the most growth in demand for new supply chain, logistics, and transportation technology. Here’s a sampling of their answers:

The transportation industry has always dealt with fraud, but nothing compares to the fraud that has infiltrated the industry in recent years. There is growing demand for fraud detection technologies, including load tracking and scheduling technology.

Emerging markets like Southeast Asia witness a rising need for last-mile delivery solutions due to urbanization. In developed regions, demand is prominent for predictive analytics and AI-driven optimization tools to enhance overall supply chain visibility and efficiency.

In response to labor challenges, we’ve observed a notable surge in demand for labor management systems across various sectors, notably in warehouses and distribution centers. These organizations face mounting pressure to enhance throughput while optimizing resources.

In Europe, some countries have started imposing a CO2 tax, and fuel costs have risen dramatically, so the logistics sector has a strong interest in reducing fuel usage through optimized routes.

In the realm of real-time tracking and visibility, there’s a surging demand for IoT [Internet of Things]-enabled devices and advanced analytics platforms. These technologies allow businesses to monitor shipments in real time, predict potential disruptions, and optimize routes.

We are seeing a rapid increase in companies below $500M in annual revenue looking to invest in digital supply chain transformations and move away from current homegrown, point-based or spreadsheet-based solutions toward end-to-end orchestration.

OVERCOMING COMPLEXITIES

Volatile conditions pose all sorts of challenges these days for supply chains. “There are so many possibilities of things that can go wrong in a big way or a small way,” says Seth Patin, founder and CEO of LogistiVIEW in Cary, North Carolina. These issues may concern the workforce, trading partners, supply chain disruptions, geopolitical disruptions, or many other factors.

For example, one LogistiVIEW customer, a large industrial distributor, found it difficult to manage workflow in the warehouse in the face of varying customer demand. “One of their biggest challenges was getting enough work released to keep all their people busy in all their different, complex picking zones, but not overwhelm their downstream conveyors or their picking, packing, sortation, and labeling operations,” Patin says. LogistiVIEW’s warehouse execution solution works with the warehouse management system to help the company strike the right balance.

Shippers also face variability when choosing transportation modes for their loads. “The availability, the capacity, and the cost structures are in flux,” says Brian Smith, CEO of Banyan Technology in Westlake, Ohio.

For example, parcel carriers will accept certain loads today that they wouldn’t have one year or 18 months ago. Can a shipment travel most efficiently by parcel, less-than-truckload, full truckload, or intermodal carrier? The answer changes over time with fluctuating rates, accessorial charges, and other factors.

Banyan’s freight execution software helps companies manage that variability. “Users can simultaneously pull back rate and load attribute data, transit time, etc. for all over-the-road modes, so they can make the best decision based on current rates,” Smith says.

At Odyssey Logistics in Danbury, Connecticut, recent customer surveys reveal several important supply chain challenges, including: the complexity of the requirements companies need to fulfill; cybersecurity; the need for a resilient supply chain; and the difficulties of ordinary, day-to-day logistics operations.

To help with those issues and more, Odyssey is investing in technology that harmonizes the disparate data that streams in from carriers, trading partners, and myriad other sources, so it can extract actionable intelligence from those raw materials.

“We’re spending an enormous amount of money on our IT systems right now, including a better data model and a data warehouse—the path that converts all that data into a structured environment, so we can then unleash AI and machine learning, and take advantage of those gains for customers,” says Glenn Riggs, Odyssey’s chief strategy officer.

For companies that want to use AI to automate supply chain decision making, one big challenge is determining how far to trust the recommendations AI systems provide. A human who analyzes data can explain the reasoning behind a recommendation and be responsible for the outcome. “When an AI engine or a model tells you something, there is not the same transparency or trust,” says Ram Krishnan, global head, customer success at Aera Technology in Mountain View, California.

To earn customers’ trust, Aera has designed its decision automation software to document the path to each decision. Say Aera’s platform recommends a particular routing strategy for a load. “We provide the underlying visibility, underlying traceability, all the way to a transaction,” Krishnan says. “It provides what I call a data genealogy to the decision maker, so they have full confidence in that decision.”