Reverse Logistics: Curing the Holiday Returns Hangover

Consumers tend to over-indulge during holiday shopping—and that means lots of returns once the buzz wears off. Instead of antacids and ice packs, retailers find the remedy in smart reverse logistics strategies and solutions.

If you made a few trips back to the mall or to your local UPS Store after the holidays to return unwanted gifts, you’re not alone. For e-commerce brands and retailers, this mass rush of returns is known as the “holiday hangover”—and it’s a doozy.

In 2022, the value of items returned by consumers across the globe totaled $1.8 trillion, up nearly three-fold since 2015, according to IHL Group, a research and advisory firm. And, IHL notes, most retailers report return rates that are outpacing revenue growth.

Along with the ballooning volume, retailers and other shippers need to wrangle with the expenses they incur to process returns. On average, it costs $30 to process a $100 return, once transportation, warehousing, and other costs are considered, according to Optoro, a provider of returns solutions.

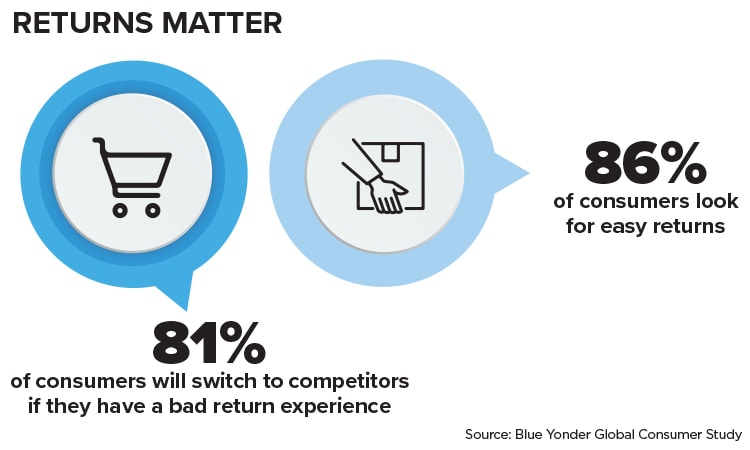

Yet, companies can’t inordinately tighten, let alone eliminate, return policies and still remain competitive. Returns are a crucial part of the shopping experience. More than four in five shippers rank the returns process as very or extremely important to customer loyalty, finds a recent Penske survey.

What’s more, consumers who make returns tend to be loyal customers. Optoro research shows approximately two-thirds of consumers tend to make most of their returns at stores or locations where they shop or spend the most.

The result is a “fundamental clash,” says Matt Guiste, global retail strategy lead with Zebra Technologies Corporation. Consumers want fast and easy returns, he notes, yet retailers often struggle to offer this cost-effectively.

Reverse Logistics Headaches

Almost 40% of online retailers list fraud as a top returns challenge, notes Vijay Ramachandran, vice president of go-to-market enablement and experience for Pitney Bowes. While fraud isn’t new, it has ramped up as more purchases have moved online. And, even honest consumers often aren’t skilled at packaging returns. The costs generated by shipments that have unreadable labels or are poorly sealed and open during transit quickly add up, Ramachandran says.

Almost 40% of online retailers list fraud as a top returns challenge, notes Vijay Ramachandran, vice president of go-to-market enablement and experience for Pitney Bowes. While fraud isn’t new, it has ramped up as more purchases have moved online. And, even honest consumers often aren’t skilled at packaging returns. The costs generated by shipments that have unreadable labels or are poorly sealed and open during transit quickly add up, Ramachandran says.

Adding urgency to the need for efficient returns is the perishable nature and seasonality of many items, particularly in fashion. “Most retailers have a limited window for re-merchandising returns,” says Matthew Hertz, co-founder of supply chain consultancy Second Marathon.

Returns also add complexity to a company’s overall supply chain network. An order might ship from one warehouse, while its return is directed to another location or an outside party, like a logistics provider, for instance.

In addition, customers often use the majority of their allowable return window, leaving retailers without those products for a period of time. To compensate, a retailer may need to hold more inventory than would be necessary if returns occurred more quickly.

Overall, organizations need to focus on both reducing the costs of handling returns and maximizing recovery of the returned items, says Gaurav Saran, founder and chief executive officer with Reverse Logix, which offers a returns management solution.

From ‘Gift Gone Wrong’ to ‘Return Right’

Vegan skincare line Soapwalla takes a proactive approach to minimizing returns. Extensive online product descriptions and trial sizes help ensure consumers purchase items they will want to keep.

In developing a returns strategy, one starting goal is reducing the overall volume of returns.

“It’s more efficient to deliver to a customer exactly what they want the first time around,” says Rachel Winard, founder of Soapwalla Inc., a provider of vegan skincare products, who has taken a proactive approach to reducing returns.

She works with clients as a “skin care sleuth” to help them identify the products that will best meet their needs. At times, she’ll suggest customers start with fewer items than they had in their carts. And by introducing travel sizes, Soapwalla enables customers to experiment with different products before buying full-size items.

The Soapwalla team also tweaked product descriptions on the website to highlight, for instance, which products are particularly effective for conditions like eczema or rosacea.

Heading Off Returns

Along with customer service, technology can also help to head off returns. A growing universe of AI tools helps customers with sizing concerns. A solution might let customers know that if they wear a size large in Brand A, they’ll likely need an extra-large in Brand B.

Virtual fitting rooms are gaining popularity, too, notes Jamie Dixon, senior director of supply chain with TMX Transform, a supply chain consultancy. Retailers offering virtual fitting rooms use augmented reality or AI to place virtual products over an image of the customer, so they can check the size, style, and fit.

With some purchases, it makes more sense to let customers simply keep the product they were planning to return. Pipsticks, an e-tailer of stickers and other low-cost paper products, takes this approach at times.

“With our price points, our policy is to tell the customer to give the product away to a friend instead of returning it,” says Nathaniel Vazquez, the brand’s co-founder and CEO. “It’s not worth the cost—financial or environmental—of a return.”

Currently, many merchants—both smaller brands and retail giants—employ third-party technology systems to help manage returns. In addition, more than three-fifths of retailers responding to a recent Zebra survey say they plan to deploy reverse logistics technology by 2026. A primary goal is more effectively managing fulfillment pressures.

To accomplish this, reverse logistics technology needs to provide three functions: visibility, transparency, and traceability, says Douglas Kent, executive vice president of corporate and strategic alliances with the Association for Supply Chain Management.

“These three pieces need to come together to give retailers a control-tower view and keep players informed of where things are,” Kent says.

One obstacle that can thwart these efforts is the level of trust between parties, Kent says, noting that not all business partners may want to share information. Varying levels of investment in different systems between parties in the ecosystem is another challenge.

Two technologies gaining favor for reverse logistics management are AI and tracking technology. AI and intelligent decision making can reduce returns fraud by helping shippers develop policies based on customers’ behavior.

For instance, advanced machine learning may help retailers distinguish honest customers from those who abuse return policies, Ramachandran says. Eventually, AI should help retailers target honest customers with benefits like early credit and fast exchanges, while discouraging fraudsters with return fees and deferred refunds.

Artificial intelligence can also streamline returns processing. For instance, AI-based returns applications can help companies determine how to use a single truck to execute both delivery and returns. Among other benefits, this boosts asset utilization and cuts carbon emissions.

Tracking solutions can help organizations prioritize returns, adds Second Marathon’s Hertz. For example, if a retailer is running low on holiday blazers in early December, management may decide to move these items to the front of the returns processing queue.

Similarly, shippers can leverage technology to implement parameters to identify items that are worth refurbishing. This may shift some returned products from “B” to “A” stock and boost recovery, says Saran.

Distilling the Right Strategies

While technology gets a lot of the buzz, companies can employ a variety of other strategies to make reverse logistics more effective. Here’s a sampling of what experts recommend:

• Price products to include return costs. In an ideal world, online consumers prefer both free shipping and low prices. Most ecommerce companies, however, need to choose one or the other, says Caleb Nelson, co-founder and chief growth officer with Sifted, a provider of logistics optimization software.

For brands to deliver both, they may want to consider boosting prices on products that are returned more frequently.

• Staff strategically. Until recently, few companies placed their star supply chain talent in the returns function, figuring it was mostly a cost center, says Dan Guide, professor of operations and supply chain management at Penn State.

Yet organizations that fail to think through their returns function and allocate appropriate resources can “leave a lot of money on the table,” Guide cautions.

• Don’t forget the KPIs. Many supply chain organizations drive performance, in part, by aggressively monitoring key performance indicators (KPIs) for their outbound logistics operations, but few do the same for their reverse logistics operations, Nelson says.

A shipper might start by identifying products that incur higher-than-average returns, and then research the reason: Is the sizing off? Is the description inaccurate?

Box? What Box?

Enabling online customers to make in-store returns is a smart way for retailers to quickly offer product for resale, helping to optimize the value of returned goods.

• Try no-box returns. No-box returns, in which consumers bring unboxed returns to a drop-off location, can help to mitigate fraud and counter lousy return packaging, Ramachandran says. Because consumers aren’t dropping off sealed boxes, they have less opportunity to ship the wrong item, or an empty box.

And when professionals pack the returns, they typically can cut the number of exceptions caused by poor packaging.

• Optimize, optimize, optimize. Returned items are often shipped between three and five times before they find their next best home, according to Natalie Walkley, senior director of marketing at Optoro. Each segment of this journey adds costs.

A decision-making engine like Optoro’s can help determine the returns destination based on resale value, cost to process, and other factors, Walkley says. That reduces the number of times returns are shipped, and accelerates the time to resale.

“Supply chain network design and optimization is becoming a critical competency,” Kent notes. Shippers need to determine if returns should be directed to the shipping entity, or a third party that specializes in returns. The decision should consider cost and customer service, as well as environmental concerns.

• Implement home pickup for high-value customers. One emerging strategy is enabling consumers to schedule return pickups—no box or label needed—at their homes, Walkley says. Because these returns are then consolidated, home pick-ups can cut restocking time, as well as shipping costs.

To be sure, home pick-ups come with a cost. E-commerce companies might decide to limit this option to higher-value customers.

• Consider using middle-mile consolidation. Middle-mile consolidation, in which returns are collected and sorted at high-volume processing centers, results in consolidated pallets of packages that cost less to ship, Ramachandran says.

This approach also presents opportunities to leverage different options for processing, such as routing higher-velocity or higher-value items so they’re returned to stock more quickly.

• Pre-print sparingly. Including pre-printed return labels with every order adds cost and complexity, as it requires including tracking numbers and barcodes in both the client’s and the carrier’s systems, Nelson says. This generates vast amounts of extraneous data if the labels aren’t used.

It’s generally more efficient to leverage technology that allows customers to print return labels once they initiate a return, he adds.

• Maximize in-store operations for returns. Ecommerce retailers with brick-and-mortar stores will benefit by implementing in-store returns procedures. When stores lack these policies, items can linger, depreciating in value and moving out of season, further cutting into potential recovery, Walkley says.

Training store employees on handling returns can make a huge difference in effectiveness, she adds.

Technology can also help here. Some reverse logistics systems offer decision engines that can help store associates determine how to handle different returns, says Guiste of Zebra.

For example, once an associate enters information on an item, an engine might let the associate know whether the return requires refurbishing. Soon, generative AI may make this even easier. An associate may be able to essentially converse with the system, which then will offer directions for handling the return.

A Renewed Focus on Reverse Logistics

While most e-commerce companies have highly calibrated and optimized efforts to protect product margins on the outbound side—such as aggressively negotiating with carriers and suppliers for lower rates and prices—the same attention is not always paid to reverse logistics.

Applying a similar focus to the reverse logistics function offers several crucial benefits, including optimizing inventory, salvaging potential value from returned items, and enhancing customer satisfaction by streamlining the return experience.

Reverse logistics is also a strategic move toward cost-efficiency, says Nelson: “There is a substantial amount of bleeding that happens on the return and reverse logistics side that needs to be accounted for.”

Giving Returns a Second Life Through Resale and Donation

One innovative way that e-tailers can boost recovery from returns is by leveraging the resale market. By 2027, the global second-hand market will almost double, hitting $350 billion, and in 2022, 52% of U.S. consumers shopped second-hand, according to ThredUp, an online second-hand retailer.

Reselling returns is also better for the environment. Some sustainability-focused brands, like Patagonia, feature sections of “gently used” merchandise on their websites—and this approach is gaining popularity.

Making it easier for consumers to donate items instead of returning is another smart choice gaining traction. Donation can both lower costs and help those in need, says Vijay Ramachandran, vice president of go-to-market enablement and experience for Pitney Bowes.

An effective process for donating returns requires aligning both consumers’ and retailers’ incentives, he notes. Consumer incentives may include credits for their purchases, and the satisfaction of ensuring their items do not end up in a landfill. Retailers’ incentives would be lowering returns costs, as well as minimizing their environmental footprint, Ramachandran notes.