Supply Chain Helps Meet ESG Goals

As corporations become increasingly focused on ESG initiatives, their supply chain and logistics partners respond with tools and services designed to help them grow sustainability and other goals.

Interest in environment, social responsibility, and governance—or ESG—initiatives is growing among businesses of all sizes across the country, thanks in large part to widespread changes in the United States and abroad.

Some changes are environmental—greenhouse gas (GHG) emissions and other factors contribute to climate change and an increase in severe weather events that impact the supply chain. Others are societal. Social pressure from the Black Lives Matter and Me Too movements are prompting organizations to evaluate their workforces and corporate cultures.

There’s also increasing stakeholder pressure to do business in a more sustainable, socially responsible way. Nearly two-thirds of businesses responding to the 2020 Gartner Sustainability Survey said they were pressured by customers to invest in sustainability initiatives while 48% said pressure was coming from investors and 48% cited regulators.

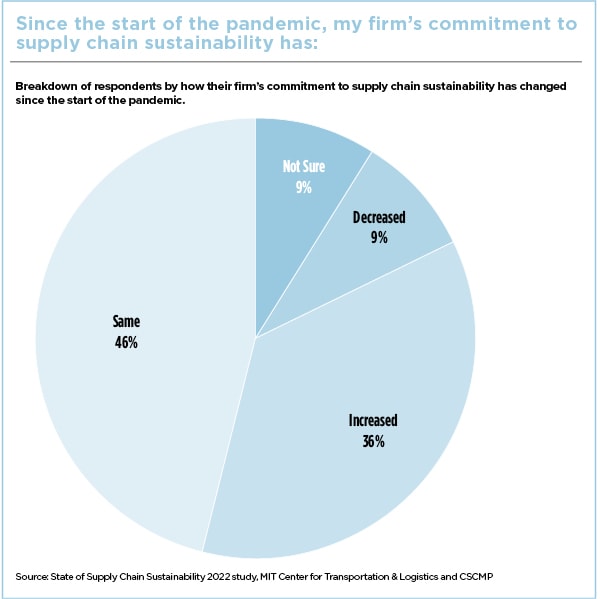

The largest year-over-year increase in pressure in 2021 came from investors, governments, and international governing bodies, according to The State of Supply Chain Sustainability 2021 study from The MIT Center for Transportation & Logistics.

In addition, the pandemic disrupted the supply chain in ways unheard of before, while supply chain globalization has made it difficult for companies to monitor their suppliers’ environmental impact and labor practices.

At the same time, many companies realize that more sustainable transportation efforts not only protect the environment, but they also save shippers money, enhance carrier profitability, and improve truck driver conditions. These factors are strong motivators for change, which is currently focused on transportation, procurement, and supplier requirements and monitoring.

Here’s how many companies are turning to their supply chains to meet their ESG goals.

Reducing Emissions From Transporation

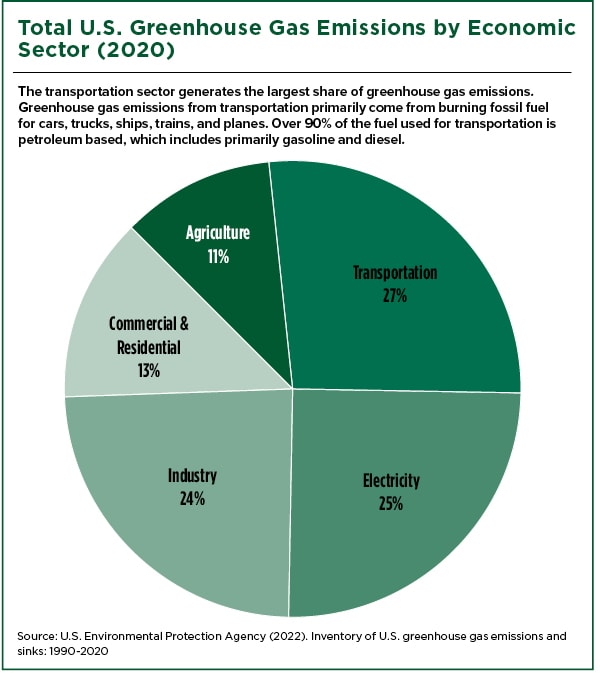

Transportation generates the largest share of GHG emissions in the United States at 27%, according to the Environmental Protection Agency. That’s why reducing emissions is a logical starting point for many companies, especially since Scope 1 and Scope 2 emissions are within their control. (Scope 1 emissions come from a company’s owned or controlled sources; Scope 2 covers indirect emissions generated by electricity, steam, heating, and cooling purchases; and Scope 3 includes all other indirect emissions in the supply chain such as those produced by suppliers.)

Technology has a significant impact on reducing carrier GHG emissions as developers work to create tools that reduce the number of empty and wasted miles, minimize idling while waiting to load, and optimize loads.

Leaf Logistics Inc. is at the forefront as it builds a data-driven, multi-party network that lets shippers, carriers, and freight brokers connect more efficiently.

CEO Anshu Prasad compares what his firm is creating to a power grid. “If you had something comparable to a utility grid for logistics that connected all the parties, you could move the same amount of freight that you move today with 80% of its capacity,” he says.

One of the technology company’s efforts reduces empty miles and keeps drivers earning when they’re behind the wheel by creating driver loops. Prasad cites an example where the system’s data has enabled a driver to run the same loop for almost two years. The driver is happier and the carrier’s margins have improved.

Drop and Hook

Leaf Logistics also utilizes its network to expand use of the “drop and hook” concept, where drivers drop a full container at a facility and hook their tractor to a pre-loaded trailer waiting for them.

It doesn’t happen a lot, says Prasad, because the process is too cumbersome when it’s not automated. His company wants to change that for both shippers and carriers because “it means that their drivers get in and out in 15 minutes rather than four hours,” he says.

The company is also using $24 billion of shipping-level data from more than 400 large consumer packaged goods companies to knit together network moves that improve efficiency and reduce emissions.

“A broker working with one load at a time would need 19,000 customers to see the number of moves we see with just four shippers,” says Prasad.

BlueGrace Logistics, a transportation management-focused third-party logistics (3PL) provider, also uses proprietary technology to reduce GHG emissions by eliminating empty legs and optimizing loads, among other things.

In addition to stressing the importance of the network size it can achieve as one of the largest 3PLs in the United States, “You also need to have a unification point for the different parties in your network to work within,” says Azad Ratzki, the company’s chief technology officer.

With visibility into both shipper and carrier systems, BlueGrace is positioned to maximize efficiency. “Because multiple parties come to us, we’re able to view both sides of the coin and optimize how goods are delivered,” Ratzki says.

“We can eliminate a leg of the journey or any number of stops and make sure that transportation is fully used,” he adds. “If shippers or carriers were doing it separately, they would have a much larger environmental footprint.”

Matching Empty Containers With Loads

In addition to reducing emissions by optimizing over-the-road loads, there are opportunities to reduce the number of empty containers returning from railyards to steamship lines at ports.

Blume Global’s Street Turns solution matches empty containers with loads that take them closer to their final port destination. In the process, it maximizes driver time and asset use while reducing fuel consumption and carbon emissions.

Once again, network size is key. “You can’t do it alone,” says Jerome Roberts, vice president of product marketing at Blume Global. “The information about asset availability requires a network with connectivity to make efficiency and transportation sustainability happen.”

Blume Global’s relationships with Class 1 railroads—the company provides the platform they use to manage their entire asset management and reservation process—helps facilitate that.

In addition to using its technology to help shippers and carriers reach their sustainability goals and improve reliability, digital freight marketplace provider Transfix also documents shipper and carrier progress in its first ESG report.

Released this year, the 40-page document details how Transfix technology is helping to eliminate inefficiencies and subsequently, GHG emissions. It also reports on progress Transfix is making toward its own ESG goals.

“It’s part of the roadmap we use to continue to give our shipper and carrier partners even more details about their CO2 impact and the efficiencies that we’re helping them drive,” says Christian Lee, chief financial officer.

“It also highlights the commitments we’re making to continue to invest in the calculations that help shippers understand their carbon footprint and reduce those empty miles,” he adds.

These types of progressive logistics partners that are helping shippers and carriers meet their sustainability goals are also turning inward to reduce their own carbon footprint.

In addition to providing tools and services that help its customers meet their sustainability goals, DHL has a number of its own sustainability goals and initiatives in place. These goals include carbon-neutral warehousing and a commitment that by 2030, 30% of its line-haul trucks will use diesel-alternative fuel.

“We have an obligation, a responsibility, as the biggest in this space to do something about it,” says Stephan Schablinski, vice president, operations excellence-GoGreen, at DHL Supply Chain.

Procurement Plays a Role

More organizations are turning to their procurement teams to examine supplier ESG practices.

“Several decades ago, the role of procurement was primarily focused around unit cost reduction and saving money,” says Omer Abdullah, co-founder of procurement intelligence firm The Smart Cube. “But in recent years, procurement has become far broader to encompass aspects of innovation, quality, and sustainability.”

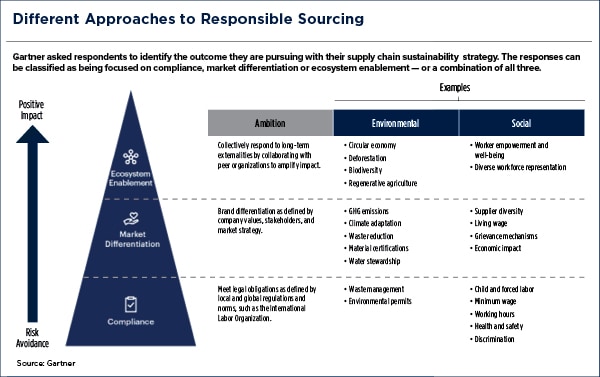

These efforts are driven partly by outside pressure. “Stakeholders ask not only about their operations, but also their suppliers’, so it’s no longer acceptable to say you only focus on your own operations,” says Miguel Cossio, procurement research director and analyst, supply chain, at Gartner. “That’s where the procurement function becomes critical to the puzzle.”

Companies are prioritizing these efforts, starting with suppliers that have the greatest impact on their businesses. They’re educating and motivating suppliers with summits; writing ESG requirements into contracts; adding sustainability to cost, quality, and delivery in supplier performance evaluations; and offering incentives such as better payment terms.

Supplier Requirements and Monitoring

Businesses use a range of tools and strategies to help them better understand supplier impact on their ESG goals, whether the issue is sustainability or social responsibility. Many start by mapping out the supply chain.

With the help of technology, organizations ask Tier 1 suppliers to provide information about their suppliers, who provide information on theirs, and so on.

“This entire process takes a lot of time and is based on a collaborative spirit among all the supply chain partners,” says Sayan Debroy, associate vice president and supplier risk intelligence expert, The Smart Cube.

Companies are also identifying sub-tier suppliers with blockchain, bill of lading data, and trade data.

John Armstrong, chief technology officer of Higg, a software platform that offers insights into materials, products, factories, and stores, cites the importance of network size in the same way that transportation technology providers do.

“While the Higg Index is exclusive to us, we’re starting to host other companies’ carbon and traceability tools to leverage the connectivity we provide,” he says. “It’s a partnership platform.”

The Higg suite of tools was first created by the Sustainable Apparel Coalition, but has expanded to related vertical markets such as toys and home goods.

Collaboration is a common denominator throughout many supply chain ESG initiatives. It’s necessary for building the large networks organizations need to do everything from reducing GHG emissions to eliminating suppliers with unfair labor practices from their supply chain.

“Radical collaboration is the future,” says Armstrong. “If you’re not radically collaborating, you probably won’t have relevance in a few years.

“The needs are too extreme, the data is too huge, and the supply chain is too complicated,” he adds.