Proforma vs. Commercial Invoice: Definitions, Examples, and Differences

There are significant differences between a proforma and a commercial invoice. Both documents look alike, so it is important to know how to differentiate one from the other.

What Is a Proforma Invoice?

A proforma invoice may answer a letter of inquiry from a potential buyer or provide the terms of a final invoice, so the customer knows what to expect.

“Pro forma” means “as a matter of form”, so these are more of an estimate or example of what the real invoice will be or look like at the end of the project.

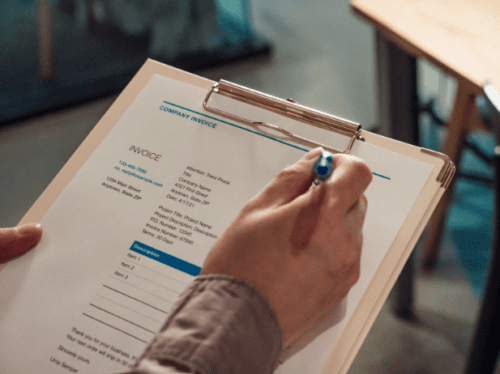

A proforma invoice includes a description of the goods, itemized list of costs, and the estimated payable amount. It also has other general details like the company or individual’s contact information, address, and buyer name.

A potential customer may ask for this invoice before agreeing to hire the company or individual. Many businesses, especially contractors, refer to the proforma invoice as a “quote” or “estimate” of the project’s final cost. The seller does not guarantee that the amount will be what is on the pro forma invoice.

When to Use a Proforma Invoice

You use a proforma invoice before the goods or services have been exchanged. The purpose is to give the customer or potential customer an idea of what the project or product will cost, so they understand what to expect as the final cost. It’s like a good faith agreement between the seller and buyer, so everyone is on the same page concerning price points.

Proforma Invoice Examples

Not all situations call for a proforma invoice. If the amount is determined before the transaction is complete and services rendered, there is no need for a pro forma, as the price is clear to everyone. Pro forma invoices are necessary when the cost may vary depending on unexpected labor, materials, or time. Below are a few examples of when a pro forma invoice may be used:

- Commissioned artwork estimation

- Construction project estimation

- Personalized clothing estimation

- Automotive work estimation

- Estimated attorney fees

- Estimated elected medical expenses

The services or goods above may require extra materials or take more time once the project is underway, meaning the seller will have to charge more for the service or product. For example, a construction project may cost more because the contractor finds mold or the buyer asked for a different kind of wood.

What Is a Commercial Invoice?

A commercial invoice is the standard invoice sent to the client after the goods are received or services rendered.

The commercial invoice reflects the project’s actual cost, including all materials, labor, and other expenses. The payable amount on the commercial invoice may be lower or higher than what is on the proforma invoice. The amount on the commercial invoice is what the client must pay to the company or individual. A commercial invoice reflects the final cost a buyer must pay.

While commercial invoices can be used by any company or individual issuing a charge, they are common in international shipping transactions and global trade. Importing and exporting goods always have a commercial invoice to declare to customs officials the amount paid for the shipment. The invoice is necessary for customs clearance declaration purposes when sending a shipment abroad.

Despite the name, commercial documents are not only for commercial purposes. Independent artists, writers, laborers, and contractors often use invoices to request payment.

When to Use a Commercial Invoice

When the job is complete, you send the commercial invoice. This invoice is the final amount, so you should not send a commercial invoice until all related expenses have been calculated. You send the commercial invoice when you are ready to receive payment for your goods. You cannot send a commercial invoice before you finish the project unless you know the exact price, in which case the proforma invoice is unnecessary.

Commercial Invoice Examples

A commercial invoice is any invoice with the final payable amount that reflects the goods received or services rendered. Some services can be paid in full ahead of time because the cost is pre-determined and not in flux. But the following bills are examples of commercial invoices that state the payable amount based on real goods and services.

- Exported goods cost

- Imported goods cost

- Final medical bill

- Final attorney services cost

- Final construction project bill

- Final catering bill

Many examples above would have succeeded with a proforma invoice, but international shipments often only require a commercial invoice.

Key Differences Between Proforma and Commercial Invoices

As mentioned, the invoices look pretty similar in layout and features. At a glance, it’s easy to confuse the two invoices, which is why it’s important to understand the differences between the documents.

The key differences come down to the purpose of the invoice and which one is appropriate at a certain stage within a project. The sections below explain the key differences between the two invoices, so you know when to use them and what they mean when you receive one.

When They Are Issued

Proforma invoices go out before the project or service finishes. A proforma invoice is almost always used before the project begins. It is often sent before the customer officially hires the company or individual. A proforma invoice may be sent during a project, but it is less common.

You cannot send a commercial invoice until all expenses are calculated, and the job is 100% done. Otherwise, the amount may be incorrect.

What They Include

The information on the proforma and commercial invoice is very similar. Both will likely include details concerning the buyer, seller, project, or product, tax implications, and payment process. Payment terms include information such as how long after project completion the payment must be sent or what forms of payment the seller accepts. The difference is the payment amount listed.

On a proforma invoice, the amount listed is only an estimate based on expected costs. A commercial invoice amount shows what must be paid based on real costs. A commercial invoice frequently includes an itemized list of the precise expenses that contribute to the final payable amount.

How They Are Used

A proforma invoice gives the buyer an idea of what they will have to pay. For the seller, proforma invoices can help budget their expected income. A commercial invoice will be saved for taxes and accounting purposes for both parties.

Bottom Line

Not every business uses commercial and proforma invoices, but they can be beneficial for accounting and communication purposes. Remember, proformas come before the goods or services, and commercial invoices come after. Proforma vs. commercial invoice comes down to the estimated cost vs. the actual price.