9 Ways to Enhance the Customer Experience

Providing a five-star customer experience is the name of the game for e-commerce and omnichannel retailers and brands. Here are some best practices to keep your customers coming back for more.

Until recently, the supply chain operated behind the scenes and invisibly to most customers, and was often viewed as “boxes on trucks,” says Jess Dankert, vice president, supply chain with the Retail Industry Leaders Association.

That’s no longer the case. “Supply chain plays a key role in the customer experience,” Dankert says, noting this encompasses both e-commerce and brick-and-mortar retail. “Ensuring the products people want are on the shelves is a big part of the customer experience,” she adds.

Similarly, brand manufacturers selling directly to consumers “need to behave like retailers, as consumers want the same experience,” says Tom Enright, research vice president with Gartner’s consumer retail team.

Facilitating seamless customer experiences does more than build loyalty, as important as that is. It also drives companies’ growth. “Supply chain has moved from being an enabler of growth to being integral for growth, especially in e-commerce and omnichannel,” says Sameer Anand, principal, Americas supply chain practice leader, with EY Parthenon.

Here are ways retailers and brands can enhance their customer experience.

1. Make checking out easy and efficient.

The measuring stick is “how close is this experience to what Amazon customers are used to?” says Matt Crawford, general manager of shipping with BigCommerce, an e-commerce platform provider. Does the site offer one-click checkout? Can customers finish a purchase without creating a profile?

2. Ensure inventory information is accurate.

Accurate inventory information remains a basic, but critical function. If a customer places an order because the site indicates the item is available, it needs to be available.

“A consumer is a statistic of one,” says Bob Klunk, president of Respected Connections, an e-commerce consultancy. If customers receive the wrong item, or no item, they are 0% happy, not 99% happy, he adds. A company that ships 10,000 orders at 99.5% accuracy will have 50 people who aren’t happy—and at least some will write reviews.

Customers shopping at brick-and-mortar retailers also expect accurate inventory information online, says Emily Pfeiffer, principal analyst covering commerce technology with Forrester. About one-third of U.S. consumers are less likely to head to a retail store if they can’t check the inventory online first, even when they don’t plan to shop online, she says.

3. Offer timely shipping updates.

It’s no longer enough to send tracking numbers that let customers look up the status of their orders themselves. Consumers now expect automated emails or texts that provide order status.

Fortunately, the technology needed to offer this information is generally available as software-as-a-service (SaaS) solutions that don’t require millions of dollars and months to install.

4. Ship efficiently from anywhere.

Until recently, many businesses relied on their enterprise resource planning (ERP) or internally developed systems to manage order flow. “These no longer cut it,” Pfeiffer says.

The reason? They can’t pull enterprise-wide inventory and serve local availability and delivery promises to customers in near-real-time, she adds. And, many consumers have become accustomed to fast and free shipping.

Instead, a modern order management system or distributed order management system (DOMS) that enables retailers to manage inventory across multiple locations from a single platform is critical to delivering stellar customer experiences. These systems also can optimize inventory and fulfillment, mitigating costs.

Such solutions also help companies work with logistics providers to build effective distribution networks, without having to open multiple distribution centers. “There’s no way you can pour concrete fast enough to catch Amazon,” Klunk says.

Retailers that convert brick-and-mortar stores, or portions of them, into distribution centers for online orders not only can fill orders, but also can reduce the empty miles distribution trucks typically rack up moving inventory from store to store, says Jonathan Wright, global managing partner, finance and supply chain transformation and sustainability services with IBM.

Artificial intelligence can extract consumption patterns from the data, infusing models with a level of prediction accuracy previously unthinkable. Customers benefit from more efficient and targeted deliveries.

5. Consider marketplaces and social commerce sites.

In 2021, Amazon’s share of U.S. e-commerce sales topped 56%. To capture customers, most e-commerce businesses need a presence on one or more marketplaces, Enright says.

And it needs to be the right marketplace(s). If a business specializes in certain products—say, luxury watches—and there’s a marketplace for those products, the company likely will benefit by offering its products there.

6. Offer hassle-free returns.

As e-commerce boomed over the past few years, most of the focus was directed at the initial customer experience. “Nobody dug around too much in returns,” says Chuck Fuerst, vice president of marketing with ReverseLogix, which provides returns management solutions.

Yet, roughly 30% of apparel purchased online is returned, as consumers’ homes have become dressing rooms. The lack of focus meant many returns experience were disjointed and frustrating.

Now, savvy e-commerce retailers recognize that easy, efficient returns are a key element of strong customer service. Consumers are looking for return options, like the ability to drop off returns at a nearby location. They also want quick refunds, and communication throughout the returns process.

Emerging technology allows companies to leverage insight from the items returned. For instance, a system might collect data showing customers repeatedly say they’re returning one brand’s size 10 pants because they’re too small, Fuerst says. The retailers can then determine if they need to adjust sizing.

A strong returns function also allows companies to leverage the growing interest in re-commerce and the circular economy. This can appeal to customers, while also helping to protect the environment.

7. Focus on packaging and the unboxing experience.

As anyone who has opened a birthday or holiday gift knows, presentation matters. Nearly half of consumers ages 18 to 29 indicate that gift-like packaging makes them more excited to open their packages, the Dotcom Distribution 2021 eCommerce Consumer Study found. The Unbox Therapy channel on YouTube boasts 18.2 million subscribers.

At a minimum, consumers’ packages should arrive intact. The packaging should accurately represent the brand. It should also include the packing slip and return label. Nearly half of consumers also want surprise giveaways included with their orders, the Dotcom survey found, while about 40% would like coupons.

8. Leverage order and sales data.

E-commerce retailers that implement solutions to leverage order, sales, and other data can ensure they’re carrying the products consumers want and locating them where they’re in the greatest demand.

They also reduce the risk and cost of carrying products that aren’t selling, says Mike Graziano, consumer products senior analyst with RSM US LLP. This insight can boost both customer service and performance.

9. Invest in sustainability.

More than half of 18- to 29-year-olds, along with 45% of 30- to 44-year-olds, support the circular economy, the DotCom survey found. What’s more, businesses that invest in sustainability can benefit; IBM research found that companies that have invested in digitization and sustainability enjoy stronger performance than their peers.

Consumers’ growing interest in sustainability means retailers and manufacturers need to begin considering the complete lifecycle of the products they offer. “Offering this level of circularity to consumers can help differentiate your offering in a heavily commoditized market,” Wright says.

Organizations that can provide a seamless, enjoyable online customer experience can set themselves apart in an increasingly crowded e-commerce retail landscape. “You have to do something to make the customer experience more worthwhile,” says Graziano.

Amazon vs Walmart: Who Owns the Market?

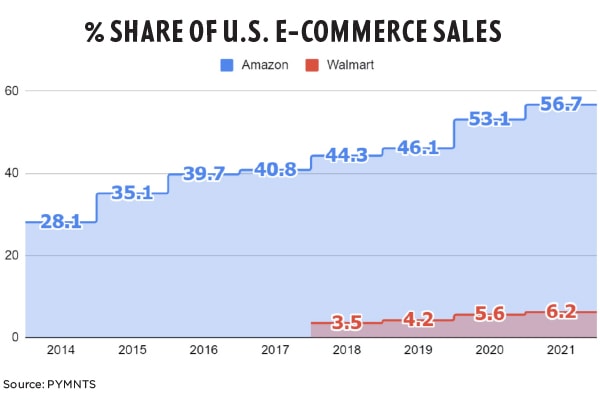

Nearly 60% of all online retail purchases in the United States were done on Amazon in 2021, according to new PYMNTS data. This reflects the company’s tightening grip on e-commerce sales and continues the stair step market share advance it has made over the past 20 years.

In fact, the new findings defy the logic that says it gets harder to grow a large business: Amazon doubled its share of the domestic retail market to 56.7% in 2021 from 28.1% in 2014.

To calculate Amazon and Walmart’s respective slice of the overall and digital retail sales pies, PYMNTS uses a gross merchandise value method which backs out things like revenue from Amazon Web Services, but includes the full dollar value of everything sold, even when an item is sold and fulfilled for a third party for a 10-15% selling commission.

The findings also show how much Amazon dominates Walmart when it comes to online-only sales, having added more than 3.5 percentage points to its share of digital sales last year, completing a 10-percentage point COVID-era jump since 2019.

By comparison, during that same two-year pandemic period, Walmart’s share of domestic digital retail sales has grown nearly 50%—albeit off a much smaller base—ending 2021 with a 6.2% portion.

What does it all mean? Despite Walmart’s efforts and the investments it has made to grow e-commerce sales and diversify its traditional reliance on the 5,000 physical store locations that dot the country, the digitally native Amazon still holds nearly a 10-time lead over its rival on this front.