Global Logistics—September 2012

Brazil Invests in Infrastructure

Infrastructure performance and transportation connectivity have long dogged Brazil’s efforts to grow its economy. But the overwhelming success of London’s 2012 Summer Olympics, and the mantle of responsibility and expectation that befalls the next in line, may force the issue.

Brazilian President Dilma Rousseff recently announced a $60-billion-plus investment package to enhance the country’s failing road and rail systems—part of efforts to solve serious transportation bottlenecks, spur a sputtering economy, and perhaps save face to the global community when it plays host to the 2014 World Cup and 2016 Summer Olympics.

The project includes adding 6,200 miles of rail track and building or widening 4,660 miles of federal highways. The government is expected to soon announce other projects aimed at airports, ports, water transportation, and any other areas where serious deficiencies are hobbling the country’s growth.

Brazil’s economy has performed well during the past decade, and has been largely unaffected by the global economic crisis that swept across the United States and is now plaguing Europe. But long-term growth expectations are muted by current transportation and logistics obstacles. For example, this recent stimulus is projected to alleviate bottlenecks that make it challenging to move large volumes of natural resources from far-flung fields and mines to foreign markets—commodity trade vital to important export sectors.

China, North Korea Get in the Zone

Kim Jong-Il’s death, and the succession of his son Kim Jong-un to the throne, raised speculation that North Korea may be on the precipice of something more than a generational change at the helm. And it may have some help from a close ally.

China and North Korea are speeding development of two special economic zones on their shared border in a bid to shore up North Korea’s crumbling economy, according to a Los Angeles Times report.

As North Korea’s chief ally and anchor of a $5.7-billion trade relationship, China is also a key resource for a country that has been economically isolated because of U.N. sanctions, as well as poor roads and utilities.

China will supply infrastructure and power to the two economic zones. One is located on islands in the Yalu River and will focus on tourism, finance, and technology; the second is situated in northeast North Korea and will develop logistics and manufacturing.

The move underscores the value China sees in North Korea—namely a labor pool of 25 million people. As production costs continue to rise with China’s middle class, especially along the eastern coast, it sees ample opportunity to tap cheap manufacturing next door.

North Korea has a reputation for exporting workers to other countries—notably Russia, but more recently China, too—and pocketing the profits rather than investing in its own domestic industries and infrastructure. China would prefer it take the latter approach as a measure toward building more stability in eastern Asia.

Whether North Korea can leverage this latest opportunity to enact economic reform, or Kim Jong-un is merely exploiting this gambit to solidify his new position of leadership, remains to be seen.

UK Parcel Customers Receive Royal Treatment

UK mail and parcel delivery services are becoming more feature-friendly. For the first time, Royal Mail will begin leaving packages with neighbors under a new “Delivery to Neighbor” initiative. The initiative follows a pilot period where 92 percent of Royal Mail customers whose item was left with a neighbor offered positive feedback about the experience; 90 percent of neighbors responded in kind.

If the “flat next door” isn’t a good enough option, shippers might consider using Amazon’s new CollectPlus delivery service, also exclusive to the UK. The program allows customers to have goods delivered to any one of 4,700 local corner shops in its network. The shops provide a local collection and drop-off point with extended hours of business that are more accommodating to people with busy work days.

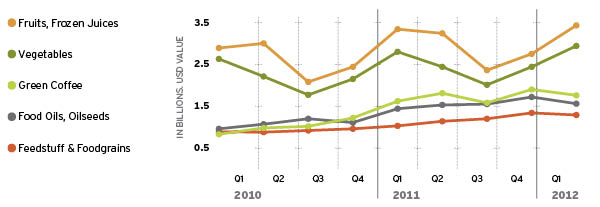

U.S. Imports for Select Agriculture Products

U.S. imports of food items—mainly fruits and vegetables—increased significantly in the first quarter of 2012. The majority of products shown in the chart originate in Canada and Mexico.

Panama Tips Hat to Apparel

With so much buzz about the “grand re-opening” of the canal in 2015, Panama is quietly plotting its own trade development strategy—as evidenced by a recent partnership between Panamanian company Exclusive Brands Logistics (EBL) and Damco Panama. The deal promotes imports and re-exports of apparel and fashion between Asia, the Colón Free Zone (CFZ), and Latin American destinations.

EBL, which manages luxury brands such as Ralph Lauren, Calvin Klein, Michael Kors, Anne Klein, and Izod, provides value-added services including packing and labeling to the fashion and apparel industry in the CFZ, a commercial distribution center located at the Atlantic gateway of the Panama Canal.

Under the agreement, Damco complements EBL’s capabilities with supply chain, transportation, and freight forwarding services from source to final destination. Together, the partners will promote Panama as the logistics service center to regional and global businesses looking for strategic, cost-competitive solutions to bring products to the Americas.

The current evolution in Panama’s logistics infrastructure is expected to be a game-changer for inbound supply chains from Asia to the Americas. Companies looking to develop transformational hub and distribution solutions will be able to move decision-making much closer to final markets and react more quickly to changes in supply and demand, ultimately providing better service to their end customers, says Alison Clafin, chief commercial officer in Latin America for Damco.