Airline Confidence Stays High

Tags: Air Cargo, Global Logistics, Logistics, Supply Chain

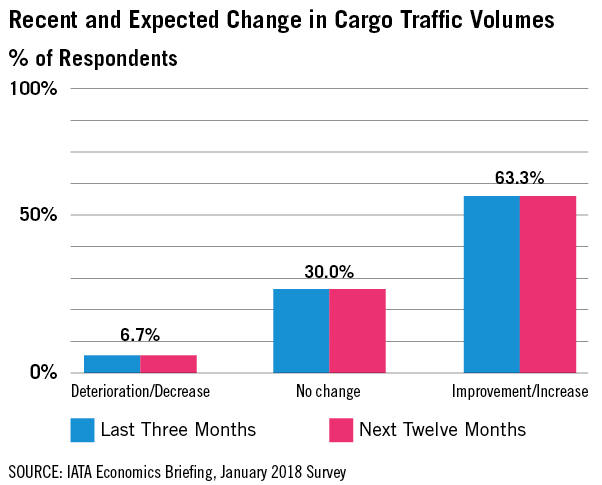

The 63 percent of airline CFOs and heads of cargo respondents to IANA's survey reporting a year-on-year rise in demand over the previous three months was the highest share for this measure since Q2 2011. Meanwhile, the proportion who reported a decline (7 percent) was the lowest in more than seven years. This combination lifted the backward-looking weighted-average score to its highest level since the post-crisis demand rebound in 2010/2011.

Airline management confidence remains high, despite concerns about higher fuel costs, and an expectation that profits will fall from 2017, according to the International Air Transport Association’s (IATA) latest Airline Business Confidence Index.

Among the index highlights:

- Nearly 75 percent of airline CFOs and heads of cargo indicate an improvement in year-on-year profitability in Q4 2017 compared with the same period in 2016.

- The majority (56 percent) expect profitability levels to improve further over the coming 12 months. Robust demand growth on both the passenger and freight sides of the business support this positive outlook.

- 38 percent of respondents report an increase in input costs in Q4 2017 compared to the same period one year ago, with many singling out the impact of higher fuel prices. The upward trend in oil prices is expected to continue to impact airline costs in the year ahead. That said, partly as a result of the strength of the economic backdrop and current demand/supply balances, respondents appear confident about the outlook for freight yields over the year ahead; both forward-looking weighted-averages scores are currently above the 50-mark.

- With 41 percent reporting no change in input costs, the backward-looking weighted-average score came in above the 50-mark for just the third time in 19 quarters. "Looking ahead, rising fuel prices were cited as a key driver for the 34 percent of respondents who reported that they expect input costs to increase over the coming 12 months," according to the index.

- 22 percent expect input costs to decrease over the year ahead, driven in part by internal productivity gains and cost reduction programs, including the adoption of more fuel-efficient aircraft.

- Looking ahead, 80 percent of respondents expect yields to remain steady or to increase over the year ahead (see chart). The forward-looking weighted-average score has trended upwards since reaching a trough in Q1 2016.

- 39 percent of survey respondents report an increase in employment levels in Q4 2017 relative to the same period in 2016—slightly below the outcome in the previous survey.

- 19 percent of respondents report a fall in employment levels in Q4, down from 21 percent last quarter, although an increase in the proportion of responses indicating no change means that the backward-looking weighted-average score fell slightly from the previous survey.

- 37 percent of respondents report that they expect to increase employment levels over the year ahead, with many citing rising demand. With a similar proportion indicating that they will keep levels unchanged, the forward-looking weighted-average score remained steady from the October 2017 survey, firmly in expansionary territory.