Manufacturers Take on Amazon

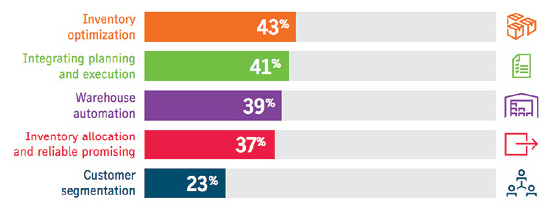

In response to the “Amazon effect” and today’s consumer demands, manufacturers are reprioritizing and focusing their technology investments on inventory optimization solutions (43 percent) and integrated planning and execution technologies (41 percent), according to findings from JDA Software’s 2018 Intelligent Manufacturing Survey. The survey suggests manufacturers are embracing a new retail-like role and willing to cater to both consumer needs and the competitive direct-to-consumer space.

Prioritizing Integrated Planning and Execution is Key

Gearing Up to Compete and Co-exist with Amazon

In an effort to address future shopping behaviors and consumer tastes, 51 percent of manufacturers say they are focused on enabling internal and external collaboration across the supply chain. Many manufacturers say they are also focused on demand sensing (44 percent) and/or data science (33 percent) to improve forecasting.

Additionally, 31 percent of manufacturing respondents reveal a commitment to integrated planning, wherein their long- and mid-term planning process is integrated with tactical execution through a single, connected technology accessed by users across the supply chain. A key part of being able to meet consumers’ changing needs is based on how well companies integrate sales and operations planning (S&OP) with sales and operations execution (S&OE). On this front, two-thirds of manufacturers are falling behind.

“Even while our data shows a portion of respondents understand the importance of prioritizing both short-term execution and strategic long-term planning, too often we see manufacturing companies focused on one and not the other, and it’s limiting the value of their planning efforts,” says Fred Baumann, group vice president, industry strategy, JDA.

Another critical component for manufacturers to address when embracing the role of retailer is supply chain maturity. Today, there are just about as many “pre-digital” manufacturers (18 percent) as there are digitally mature manufacturers. However, while only 18 percent of respondents say they’ve reached digital supply chain maturity, nearly twice as many respondents (35 percent) anticipate they will get there within two to three years. The question is, what are they doing to make that happen, and will they ultimately be successful in catering to consumer needs?

“Supply chain digitalization is no longer a ‘nice to have.’ It’s a strategic mandate and a dramatic differentiator that drives revenue and market share growth,” says Baumann. “The companies that are investing in their supply chain today, that have support from their leadership teams, and that are positioning the supply chain function as a key point of differentiation are the companies that will excel and achieve profitable business growth.”

Given the business benefits linked to supply chain digitalization, such as greater profitability (49 percent), increased customer service levels (38 percent), reduced spend (38 percent), and increased competitive abilities (35 percent)—all of which are critical in keeping up with consumer demand—the fact remains that companies opting to put digitalization on hold for another 12 to 36 months will fall behind in more ways than one.

Prioritizing Integrated Planning and Execution is Key

No longer just a concern for retailers, the Amazon effect is prompting manufacturers to rethink and reprioritize their technology investments to better address changing consumer demands. Because Amazon’s customer service has become the gold standard, expectations for shorter order fulfillment and delivery times have beome the norm for both business-to-consumer and business-to-business companies.

SOURCE: 2018 Intelligent Manufacturing Survey, JDA Software

Gearing Up to Compete and Co-exist with Amazon

As consumer needs continue to shift rapidly, retailers are feeling the brunt of the impact. This pressure to respond to shopper behaviors, however, is also felt upstream, prompting manufacturers to reevaluate their supply chain operations.

Digital collaboration with traditional retail channels continues to be an area of focus to improve efficiency and profitably respond to consumer needs. Additionally, to retain top talent, 55 percent of manufacturers are committed to cross-training employees across all supply chain needs, and building a true center of excellence, the JDA survey finds.

Further, in direct response to the rapidly expanding influx of digital data available from sources such as the Internet of Things and social media, news, events, and weather, 78 percent of respondents plan to invest in new talent over the next 12 months to better utilize these insights.

To attract top talent, respondents are embracing mobility in the workplace (55 percent), establishing supply chain as an elite organization within their company (42 percent), and adopting cloud solutions specifically for increased business focus (36 percent).