Global Logistics Essentials: What to Know Before You Source, Import, or Export

Global logistics brings both challenges and opportunities for today’s shippers. Here, we break down the nitty-gritty details every importer and exporter needs to know.

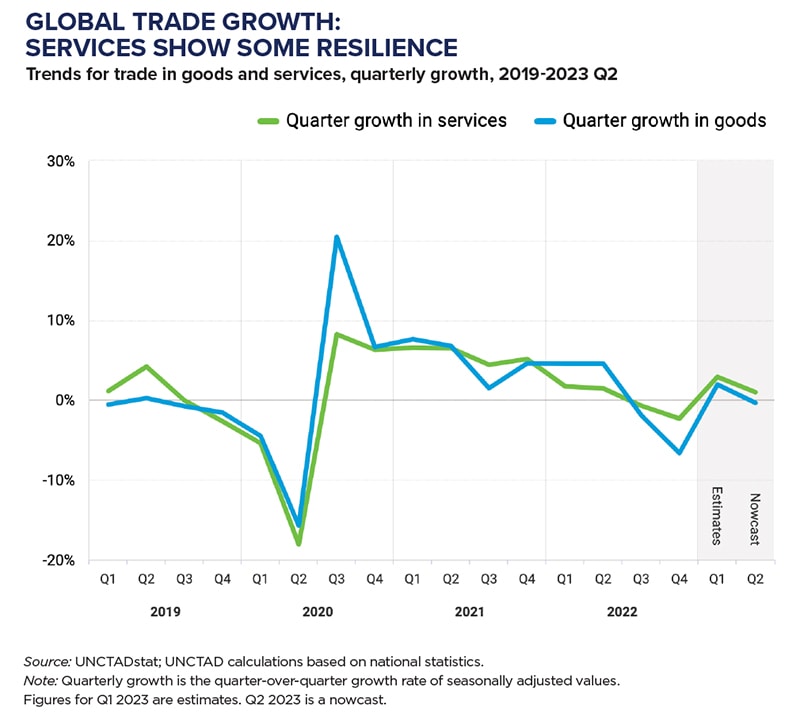

The pandemic pushed global trade into the spotlight like never before—and its importance is only growing. Global trade in goods hit $25 trillion in 2022, up 10% from one year earlier, according to the United Nations Conference on Trade and Development.

Importing and exporting continues to grow in volume and complexity, with transactions impacted by an increasing number of regulations, agreements, and policies, as well as evolving geopolitical events. Global logistics operations also are vulnerable to labor disputes as well as weather and other events largely outside any one organization’s control.

Given the difficulty and importance of effectively managing global logistics, supply chain organizations involved in importing or exporting “need to be on top of their game,” says Mark Ludwig, national leader of trade and tariff advisory services with consulting firm RSM US. They should have an understanding of the laws and agreements that govern importing and exporting, and an appreciation of the tools and expertise that can streamline these transactions.

It’s a daunting undertaking, but also a time of opportunity. Supply chain organizations that can successfully manage global logistics can reduce costs, improve compliance, and even increase market share.

Spotlight on Geopolitical Context

Navigating global logistics requires a clear understanding of the evolving global geopolitical landscape. Events like Russia’s invasion of Ukraine, for instance, continue to impact trade and logistics.

As a result of the invasion, beginning in March 2022, the world’s largest shipping companies suspended cargo services to and from Russian ports, severely affecting Russia’s supplies to many countries. Russia has been a major supplier of a range of aluminum, nickel, and other raw materials.

“Companies that source or sell into these markets are all impacted by changes in the geographical, economic, and political spheres,” Ludwig says.

Also at play are shifts in U.S. policy. The Biden administration has moved forward with a “more muscular trade policy,” says Lauren Pittelli, founder and principal of Baker Logistics Consulting. The goal, she says, is protecting American industries that are considered militarily important, as well as those important to the economy overall.

One example comes from the Department of Commerce. In October 2022, it announced updates to its export controls, with a goal of restricting the ability of the People’s Republic of China to obtain advanced computing chips, among other changes.

U.S. importers and exporters also need to monitor lists of individuals and companies that U.S. entities are prohibited from engaging in business with. The Office of Foreign Assets Control, for instance, publishes a list of specially designated nationals—or SDNs—whose assets are blocked and U.S. persons are generally prohibited from dealing with.

The lists, however, are just a starting point. “Shippers can be deceived if they don’t dig further,” says Joanna Rangarajan, managing director with the consumer and retail group of Alvarez & Marsal, a global professional services firm.

Restricted entities often can disguise themselves as passably legitimate entities to get through shipping, although U.S. Customs and Border Protection (CBP) has been quick to catch on to the changes.

Technology can also help supply chain organizations research red flags in supply entity structures so they can steer clear of potential restricted-party violations.

Trade advances Human Rights

Like many countries, America is increasingly looking to advance human rights goals through its trade policies.

One example is the Uygher Forced Labor Prevention Act (UFLPA), which went into effect in June 2022. The act helps to prohibit imports of goods that were manufactured, even in part, with forced labor from the People’s Republic of China, and especially from the Xinjiang Uyghur Autonomous Region. Since its passing, more than $1 billion in goods has been tied to forced labor, estimates Descartes.

CBP enforces the UFLPA stringently, so shippers are advised to stay abreast of the UFLPA Entity List, which the CBP continually updates.

In addition, emerging discussions around stricter labor monitoring in Vietnam and Indonesia could make shipments from these countries more susceptible to withhold release orders (WROs). (CPB issues WROs when it has reasonable evidence that forced labor was used in the production of goods entering the United States.)

However, new regulations have not yet been implemented, and given the upcoming election cycle, it’s unlikely this will be addressed until later in 2024 or 2025, according to Rangarajan.

The upshot? “Companies need to be more diligent and transparent about what they’re doing to strengthen the security of their supply chains and eliminate forced labor,” says Jackson Wood, director of industry strategy for Global Trade Intelligence at Descartes.

This includes asking all suppliers, including those beyond Tier 1—and particularly suppliers in high-risk regions—to provide affidavits that their operations do not include forced labor.

Climate change is also starting to influence trade policy. In October 2021, for example, the United States and European Union announced a commitment to negotiate a carbon-based sectoral arrangement on steel and aluminum trade by 2024.

Among other actions, the commitment toughens enforcement mechanisms to prevent leakage of Chinese steel and aluminum into the U.S. market.

To navigate the complicated, ever-expanding volume of trade regulations and agreements, importers and exporters need a “strong ecosystem of external experts,” such as brokers, attorneys, and consultants, says Ludwig. Their knowledge and insight can be particularly critical when the ownership or structure of a business or its supply chain partners changes significantly.

Companies also need to map out their supply chain and identify the number and locations of their global vendors. Importers and exporters can then prioritize interactions based on location and closely monitor business partners in high-risk regions.

Given the level of due diligence and recordkeeping required, digitizing and automating as many steps as possible is also critical.

Importers can work closely with freight forwarding partners to streamline customs processes and reduce costs. Providers also help ensure accurate classification of goods as well as compliance with trade and security regulations.

Streamlined Customs Clearance

Classification and valuation are two pillars of customs clearance, says Sergio Retamal, founder and CEO of Global4PL. Classification drives the tariffs and restrictions that apply to goods, while valuation is the basis for assessing duties and taxes.

When determining classification, it’s crucial to know the rules governing the product and its use, among other facts. A ball bearing for a plane, for example, generally is classified differently than one to be used in a toy.

Companies that incorrectly classify imports can face penalties. Moreover, while it’s prudent to ask a lawyer or broker for their informed opinion, the importer remains responsible for classification decisions.

One way to ensure an accurate classification is to ask the government for a ruling. “The U.S. Customs Binding Ruling program is one of the most underutilized means of shipping efficiency,” says Jeffrey D. Plumley, chief commercial officer and licensed customs house broker with ASF.

A ruling stipulates the correct classification for imported goods, enabling the importer to correctly plan for the duties that will be applied to their items.

Shippers also should consider becoming a participant in the Customs-Trade Partnership Against Terrorism (C-TPAT) program, suggests Matthew Fotouhi, chief technology officer with Magaya Corporation.

Shippers that join C-TPAT agree to work with CBP to protect their supply chains, identify security gaps, and implement security measures and best practices, among other steps. In exchange, C-TPAT members are considered to be low risk, and are less likely to be examined at a U.S. port of entry—which means they typically reap benefits like fewer CBP examinations and shorter wait times at the border.

Cost-Cutting Tips

A simple rule governs import duties: “You have to pay what you owe,” says Pittelli. But, it’s possible to find cost savings elsewhere.

One area is the duty drawback program. Drawback refers to the refund of certain duties, taxes, and fees collected when goods are imported and are then refunded when the goods are exported or destroyed.

Another way to cut costs is by establishing delivered duty paid (DDP) vendor relationships, says Kenneth Cochran, managing director in Alvarez & Marsal’s consumer and retail group. Under a DDP agreement, the seller assumes the responsibility, risk, and costs associated with transporting goods until the buyer receives or transfers them at a destination port.

It might seem that few vendors would agree to a DDP. However, vendors can benefit from these agreements. A DDP program could enable a vendor to work with a company that otherwise might not purchase internationally.

DDP agreements also tend to promote a “customer stickiness” that can make it more difficult for customers to leave the vendor, Cochran adds.

In the United States, de minimis admission can also cut import costs. When the value of the merchandise one person imports on one day falls at or below $800, it generally may be imported free of duties and taxes, in what’s sometimes referred to as “de minimis.”

De minimis tends to be most helpful for small shipments and shippers. (For larger shippers, it often makes more sense to import goods into the United States via consolidated freight instead.) As sales grow, companies need to weigh whether they benefit more from transportation savings or tariff savings.

Some tactics companies might consider remaining under the $800 limit—like breaking apart heavyweight air shipments into international parcel shipments—could backfire. They can increase handling costs and the risk of damages, and cut delivery predictability, says Glenn Koepke, general manager of network collaboration with FourKites.

When customs clearance goes wrong, it’s often due to incorrect data, missing paperwork, and/or poor timing on entry filings. Technology can provide an easy fix for these scenarios.

“In our digital world, robust solutions are available to generate accurate documentation, monitor filing, and determine status in real time,” Koepke says.

Smart Partnerships Pay Off

Working with freight forwarders and customs brokers can also help streamline customs processes and reduce costs. The right freight forwarder will help shippers more easily access multiple ocean carriers and gain alternative service options, for example.

A reliable freight forwarder should understand the criticality of data timeliness and quality and offer digitized operations in order to help shippers avoid delays. The freight forwarder should also be able to manage visibility data from all of a client’s transportation partners. “This ability is table stakes,” notes Cochran.

It helps to keep in mind that freight forwarders are like “travel agencies for products,” says Retamal. By ensuring accurate planning, freight forwarders give their clients a wide range of options and improve cost-effectiveness.

While cost is important, “service, fit, and value,” are critical, says Pittelli. She describes the ideal size for a freight forwarder as small enough to provide personalized service, but large enough to accommodate growth.

Lastly, a freight forwarding partner should be responsive and offer direct access to management.

To best prepare for ongoing global supply chain disruptions, forward-thinking shippers use technology to gain visibility, flexibility, and resilience across their supply chain operations.

Putting Technology to Work

While visibility has become a starting point for efficient operations, organizations also need technology that can enable connections with various global trade partners.

For instance, many containers are managed through spreadsheets, email, and phone calls, with little system-to-system connection. This lack of integration makes automation difficult and errors more likely, says Christian Roeloffs, co-founder and CEO of Container xChange.

“All stakeholder systems need to communicate,” he says.

Setting up a digital twin—essentially, a digital copy of the organization’s supply chain—allows the company to run crucial “what if” scenarios, says J.C. Renshaw, senior supply chain consultant with Savills, a property advisor.

For instance, if port workers go on strike, companies must be prepared to pivot their supply chains. Using digital twins can help supply chain professionals mitigate risk and identify ways to be more flexible and resilient.

Evolving Global Logistics

Shippers should expect the ever-expanding and constantly changing regulations that govern importing and exporting to continue. To manage the global supply chain effectively in this environment, supply chain organizations and compliance and logistics operations need to be resilient and transparent.

Similarly, disruptions, whether from natural events or geopolitical tensions, are likely to remain a risk. What’s the best way to prepare?

“Look for ways to gain flexibility and resilience by leveraging technology in your supply chain operations,” Roeloffs suggests.

Equally as important, all functions across organizations should pay attention to global logistics concerns, including how to value and classify goods, comply with regulations, and take advantage of government trade programs, Ludwig says. This collaborative focus and strategic awareness boosts an organization’s ability to identify and leverage opportunities to streamline operations and increase their competitive edge.

Ultimately, when it comes to global logistics, “Within the complexity, there is opportunity,” Ludwig says.