Packaging Innovations 2023: Making Ecommerce & Sustainability a Package Deal

With a focus on ecommerce and sustainability demand, visibility, and improved efficiency, packaging systems are rapidly changing with the times.

Every detail in the supply chain today is under the microscope to be studied, examined, weighed, and tested in search of new efficiencies and advantages. Packaging is among those components to receive a heightened emphasis in recent years, resulting in new innovations that are helping in a variety of critical ways.

“The profile of packaging has never been so high,” says Rachel Fellows, sales director for retail & 3PL national accounts for Macfarlane Packaging, a distributor of protective packaging products. “Retailers have high expectations for their packaging and all stakeholders’ demands need to be heard and considered.

“Balancing the different priorities of various departments within a packaging solution is a complex task, especially when sustainability and circularity remain at the heart of the decision-making,” she adds.

The challenges those in the supply chain face now are less intense than during the pandemic. Though that might lessen the pressure of the moment, “companies are becoming more flexible in making changes in order to keep their supply chain agile,” says Brian Techter, senior vice president, packaging solutions, forms and labels for RRD, a Chicago-based company that provides marketing, packaging, print, and supply chain solutions.

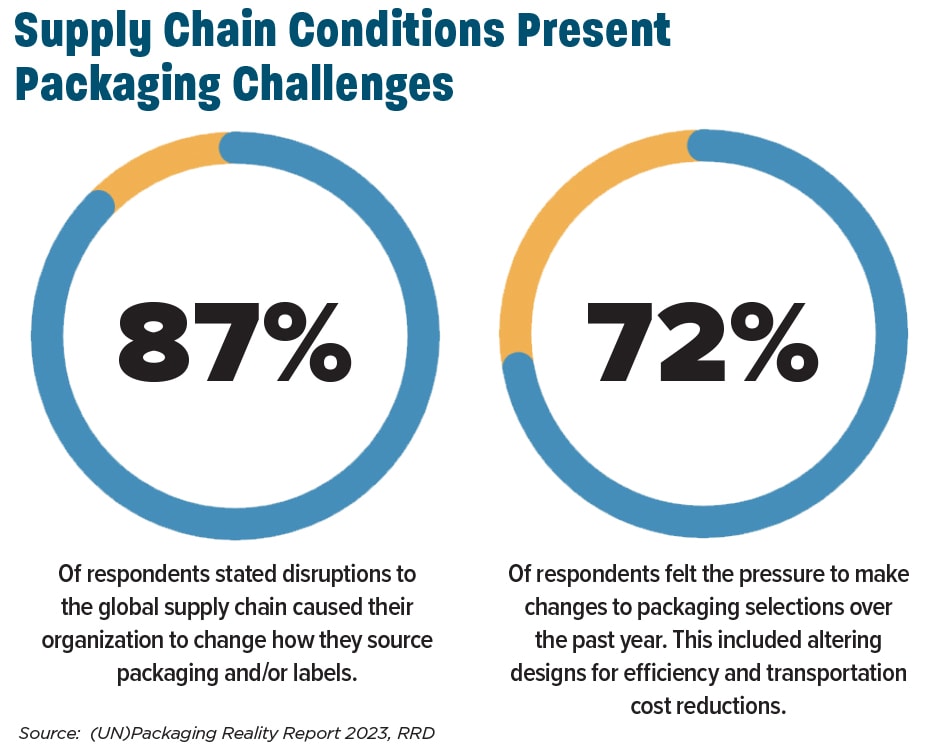

Packaging is changing in a climate that requires adjustments. While packaging and label decision-makers began to see some supply chain and market conditions stabilize in 2022, 87% of those participating in RRD’s 2023 (Un)Packaging Reality survey still report that disruptions to their global supply chain prompted their organization to change how it sources packaging or labels.

Of those respondents, 72% had to make packaging selection changes during the year. Nearly three-fourths of respondents made changes to minimize cost, and 60% altered their designs for efficiency and transportation cost reductions.

The survey also shows that packaging decision-makers are planning their selections more in advance than in the past.

“Based on this data, we can see companies paying closer attention to how, where, and what packaging materials they source, and how that will affect their overall supply chain,” Techter says. “It’s an intricate process, not a one-size-fits-all.”

Packaging that integrates technology such as RFID labels enables item-level tracking to optimize inventory management and supply chain efficiency.

Sustainability Gains Attention

No topic in packaging today is getting more attention than sustainability.

“Sustainability was just about all everyone was talking about” at a UN Subcommittee Meeting of Experts on the Transport of Dangerous Goods in July 2023, says Jay Johnson, senior manager of Labelmaster Services at Labelmaster, a provider of products and services for dangerous goods and hazardous materials transportation.

“Five to 10 years ago, people complained about the cost of packaging, but they weren’t as worried or mandated to get packages back, or to use them again, or to not use certain types of materials to ship because of how they impact the landfills and the waste streams,” Johnson says. “But we’re getting that now.

“You almost have to apply for an exception or exemption to be able to use certain types of packaging material because countries don’t want them to be added to their waste streams,” Johnson notes.

Sustainability in packaging remains a top priority for the industry, with 90% of decision-makers in RRD’s report calling it a key consideration. Innovations such as the reduction of material waste (72% of respondents), material recyclability (66%) and the inclusion of recycled material (50%) are among the key areas of focus in sustainability packaging trends.

Sustainable packaging can include biodegradable, compostable, or recyclable packaging options and might include lighter packaging solutions that provide the same level of product protection as heavier counterparts. Circularity—when an item is renewed or regenerated rather than wasted—is also a component of sustainability gaining attention and exploration.

“Packaging designers consider the question of how to produce material more sustainably without negatively impacting performance so retailers can focus on getting the highest-quality products without sacrificing effectiveness,” Techter says.

Macfarlane also has seen that sustainable packaging is “a huge priority” for retailers, Fellows says.

“Once viewed as a commodity product, more businesses are seeing the potential environmental savings that the right packaging can offer,” she says. “On top of this, consumer pressure is mounting for businesses to continue to swap for sustainable packaging alternatives.”

Labelmaster’s new Capsuloc reusable, plastic hazmat shipping container provides a safer, more convenient way to ship flammable liquids and other hazmat compared to metal paint cans that leak, dent, and require tools to open and close.

Reducing packaging, improving protection

Mcfarlane’s 2022 Unboxing Survey revealed almost one-third of consumers will not buy again if the retailer does not use sustainable packaging. “We see this manifest with more retailers considering the total carbon dioxide emissions of their packaging throughout the entire packaging lifecycle,” Fellows says.

“Solutions are centering around reducing packaging materials while improving product protection,” she adds. “When weighing the swap to sustainable packaging alternatives, it is important for retailers to consider not just the material being used but all areas of the supply chain that the packaging touches.”

Some new, sustainable packaging materials can be more expensive and not perform as well as previous versions. At the UN subcommittee meeting, Labelmaster arranged a presentation on aligning dangerous goods regulations to support sustainable packaging systems—a particularly difficult challenge.

“It’s certainly a mandate from everybody we’re dealing with globally to provide easier package sustainability and recyclability, but sometimes you can’t do that with dangerous goods because they react negatively,” Johnson says. “But there are attempts to adjust insulated packaging, chemical packaging, and infectious packaging to be able to better provide safety for the public.”

Aligning protection and sustainability will continue to require adjustments. The safety of those handling and transporting the packages—as well as the public along the way—remains paramount.

“In some cases, sustainability causes some transportation problems,” Johnson says. “As industry moves and things change, and you switch from hardwood virgin paper to soft wood to recycled, the quality of the fiber strands, the amount of glue, and the structure of the cardboard can be affected to the point where boxes do not perform as well as they used to.”

Similar challenges can emerge with using recycled plastic or recycled fiberboard that must meet both performance and environmental standards. Many manufacturers and other parties are swiftly trying to refine their packaging systems as a result.

In addition, some shippers face stiffer requirements related to the protection their packaging provides while being transported.

“We see a lot of that, which isn’t a bad thing,” Johnson says. “Recognizing that packaging needs to perform a certain way during transportation to protect the public needs to be ingrained.”

For packaging providers and their clients, now is a time of testing new techniques, processes, and materials to explore usability and performance. The challenge can be especially steep for hazardous materials transportation.

“There’s a heightened awareness to try to use sustainable products for hazmat transportation, but not all the recycled sustainable products requirements are able to protect dangerous goods in transportation without compatibility or performance issues,” Johnson says.

“You still need a package strong enough to protect the public from the risk or hazard an item represents in transportation while at the same time is cost effective, easily available and usable, and doesn’t create massive amounts of waste in the process,” he adds.

Ecommerce affects regulations and compliance

The growth of ecommerce caused many companies to seek help learning about regulations that apply specifically to ecommerce-related packaging.

“One of Labelmaster’s big projects has been helping people develop their ecommerce programs and helping them realize that the postal regulations are not the same as regular ground or air or vessel,” Johnson says. “Each mode and each competent authority has several differences. Companies need to get a handle on what they are doing, how the products are regulated, and what the packaging requirements and limitations are.”

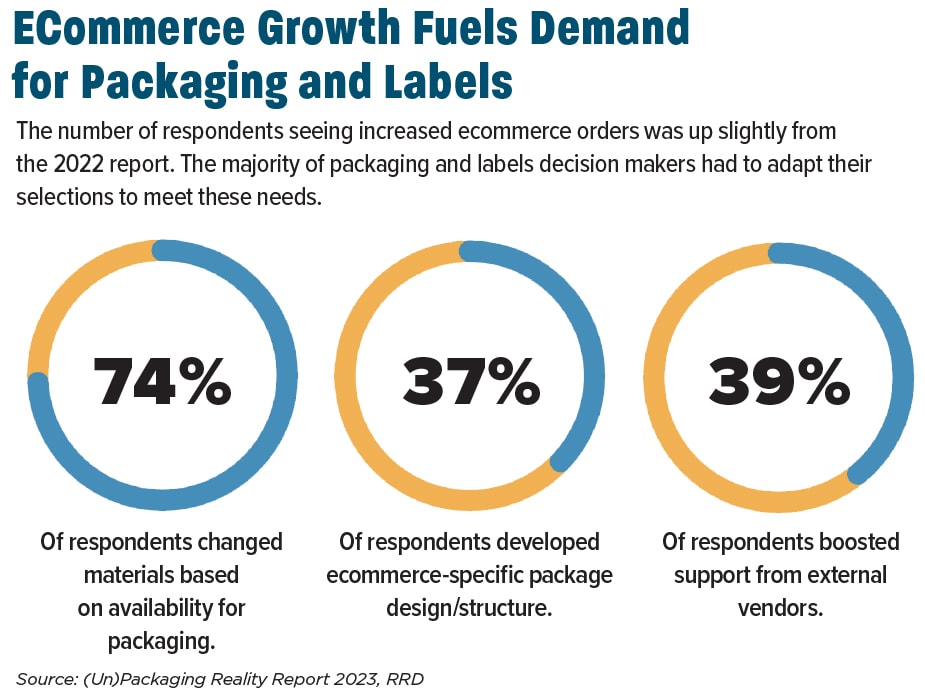

Ecommerce is having a clear impact on packaging trends. In RRD’s survey, 60% of respondents say that their company had seen an increase in ecommerce orders over the previous year.

“To keep up with demand, packaging and label specifiers had to adapt their selections to meet these needs—74% changed materials based on availability for packaging, and 64% did the same for labels,” Techter says. “A focus on ecommerce packaging design is rivaling brick-and-mortar packaging design, which is an interesting development as ecommerce continues to outperform previous years.”

Smart Packaging

The pressure on delivery speed that has emerged from ecommerce’s rise has made supply chain visibility and tracking more important than ever. That has drawn increasing interest in smart packaging that integrates technology and enables item-level tracking. Smart packaging can strengthen efficiency by providing companies with data to improve inventory management, among other benefits.

“We’re excited about Radio Frequency Identification, or RFID, mainly because it directly affects supply chain efficiency,” Techter says. “While RFID is not new to the industry, resurgence is happening as top U.S. retailers mandate their suppliers pre-label certain products with RFID labels to optimize inventory management and supply chain operations.

“Whether you’re in a store or warehouse, scanning an RFID label tells you all about product origin, movement, and destination, helping the retailer provide a more seamless experience for consumers,” he adds.

From a technology perspective, “a particular trend that has great value is the ability to use QR codes and other technology to drive safety and security in specific areas,” notes Peter Anderson, chief supply chain officer for WestRock, a packaging solutions company based in Atlanta.

He also points to smart packaging’s value in providing increasingly sophisticated measurements of the conditions that products are stored in while being transported.

“Where smart packaging is concerned, an exciting capability that contributes to the integrity of the supply chain is the ability to track temperature variance in temperature-controlled environments—particularly valuable in the food and beverage space, as well as in pharmaceutical health care packaging—namely clinical trials,” Anderson says.

Optimizing Packaging to Limit Waste

Standard go-to options in packaging are being replaced with highly optimized variants. Optimized packaging aims to have the ideal size, material, components, and design for individual products, which limits waste and maximizes protection.

For example, the in-house design team at Macfarlane’s Innovation Labs has engineered an ecommerce package that is 14% stronger than a standard European Federation of Corrugated Board Manufacturers style carton while using 13% less material and being 35% less wasteful and removing the need for gluing.

“The goal of the variants is to deliver a better brand experience, reduce the amount of void fill required, and provide increased strength and performance,” Fellows says. “These needs must be balanced by requirements for ecommerce packaging to be curbside recyclable and to offer some kind of secondary use, with a view to reducing overall CO2 emissions.

“Space and energy-efficiency will continue to be given more consideration,” she adds. “Total cost reduction will be a big priority, and optimized packaging can play an important role in managing costs and tackling challenges such as storage and labor costs.”

The array of packaging options and challenges can prove confusing. For shippers and other supply chain parties, the key often is homing in on their specific needs and demands and analyzing how the right packaging can bolster their overall supply chain.

“You can make packaging do as much or as little as you need depending on what your goal is,” Johnson says. “Often it’s just figuring out what you are trying to accomplish and identifying your pain points.

“Then you just need to invest to help you overcome those challenges.”

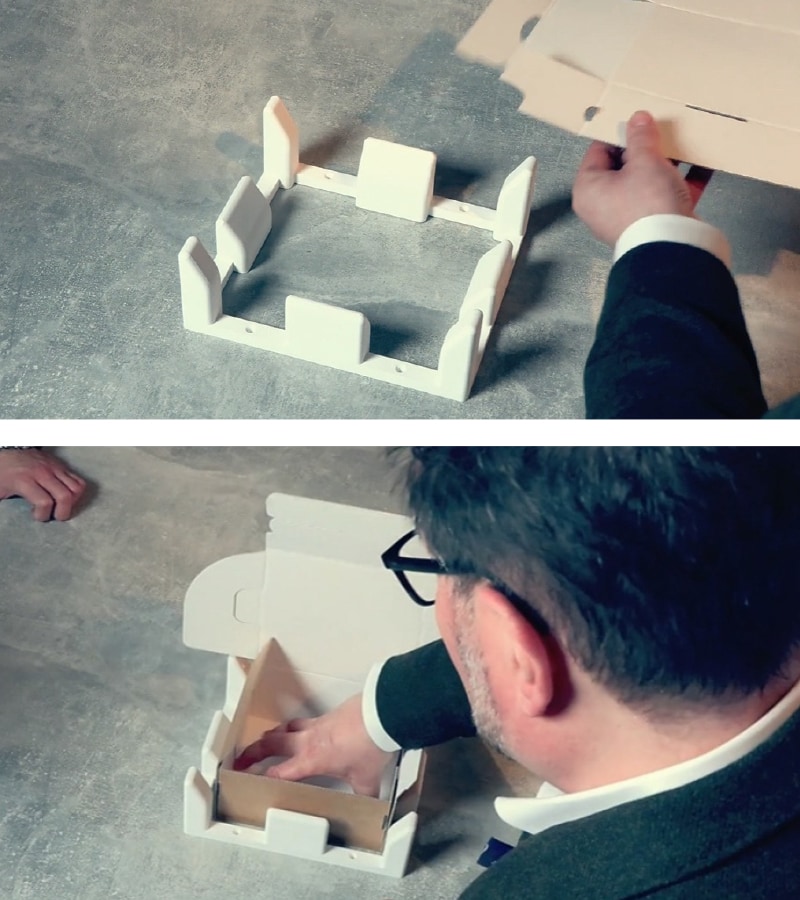

Building Boxes in Seconds

Macfarlane Packaging launched a new rapid box assembly system that helps packers build cardboard boxes in seconds and increases packing efficiency by up to 70%.

Created by Macfarlane’s Innovation Lab team, the new patent-pending solution has been designed to increase operational productivity by reducing manual box assembly times from 10 seconds to less than three seconds.

The unique piece of packaging equipment will be made-to-order for Macfarlane customers and works with Macfarlane-exclusive box designs that have been optimized to provide more performance strength while using less material—increasing pallet fill and reducing transportation costs and CO2 emissions.

The 3D printed units can quickly assemble boxes up to 16 inches x 12 inches, with variable depth options. This makes the solution attractive to online and multi-channel retailers packing a high volume of small parcel size packages.